How to Calculate Marginal Revenue

Use the total revenue. Total revenue is almost always higher than sales revenue because it is the cumulation of all revenue generating channels of a company.

Calculate the total revenue.

. Before you calculate marginal cost you should understand change in costs and change in quantity. For a business with economies of scale producing each additional unit becomes cheaper and the company is incentivized to reach the point where marginal revenue equals marginal cost. The formula above breaks this calculation into two parts.

Sales marketing customer success and investments. Total revenue is all income generated from the total sales of goods and services regardless of revenue source. When it comes to running a business the list of expenses to track is endlessYou need to know the cost of payroll marketing supplies rent commissions and the cost of goods sold among others.

As long as marginal profit is positive producing more output will increase total profits. Therefore the marginal revenue is the slope of the total revenue curve. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate.

At this point marginal revenue and marginal cost are equal and the vertical distance between revenue and cost AB is greatest. Marginal revenue equals the sale price of an additional item sold. In order to determine the marginal revenue for a business the first step is to find the total revenue.

Diagnosing your marginal revenue. Marginal Effective Tax Rates. This article is a guide to the Marginal Revenue Formula.

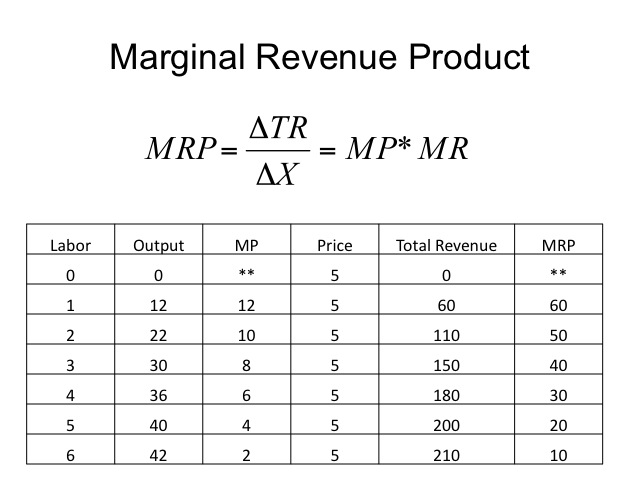

To calculate the marginal cost divide the change in cost by the change in quantity or the number of additional units. For example if the companys revenue doubles from 1 million to 2 million it has experienced 2 revenue growth. The demand for an additional amount of labour depends on the Marginal Revenue Product MRP and the marginal cost MC of the worker.

How to calculate your revenue growth rate. To determine which pricing strategy works best for your business youll need to understand how to. As a result the company keeps marginal revenue inside the constraint of the price elasticity curve but can adjust its output and cost to optimize its profitability.

If you work in management or accounting or run your own business you have likely come across the term cost of goods sold. This means that marginal. 255 divided by 106 6 sales tax 24057 rounded up 1443 tax amount to report.

Labour demand is a derived demand. Marginal revenue is the additional revenue that a producer receives from selling one more unit of the good that he produces. AVERAGEC3C20 replace C20 with the address of the actual last cell containing a growth percentage in.

Calculate Break-Even Sales Calculate Break-Even Sales Break-Even Sales are sales where a companys total revenue equals its total expenses resulting in a zero profit. In these cases there is a much simpler formula you can use to calculate marginal product. It is calculated by dividing the companys total fixed expenses by the contribution margin percentage.

This table repeats the marginal cost and marginal revenue data from this table and adds two more columns. All you need to remember is that marginal revenue is the revenue obtained from the additional units sold. Total utility is the aggregate level of satisfaction or fulfillment that a consumer receives through the consumption of a specific good or service.

An example would be a production factory that has a lot of space capacity and becomes more efficient as more volume is produced. Finally total profit is the sum of marginal profits. While useful in some contexts statutory marginal tax rates do not paint a complete picture.

The expression militaryindustrial complex MIC describes the relationship between a countrys military and the defense industry that supplies it seen together as a vested interest which influences public policy. Marginal tax rates are spread into seven tax brackets and grouped into four taxable households. Marginal Revenue is easy to calculate.

Marginal revenue change in revenue change in quantity. That is hiring labour is not desired for its own sake but rather because it aids in producing output which contributes to an employers revenue and hence profits. Calculate marginal product simplified Ln - Ln - 1 is often equal to 1.

This will likely occur when manufacturing needs to increase or decrease. Effective marginal tax rates are useful to calculate because they account for the multiple layers of taxes such as the income tax and payroll tax alongside relevant deductions and. Learn about the marginal cost of production and marginal revenue and how the two measures are used together to determine the profit maximization point.

Calculating marginal revenue involves following several key steps. To calculate marginal revenue divide the change in total revenue by the change in the quantity sold. As output increases revenue rises more rapidly than cost so that profit eventually becomes positiveProfit continues to increase until output reaches the level q.

It is a progressive tax system where individuals who earn more pay more taxes while those in the lower income tax bracket pay less. If your business carries and sells inventory. It is defined as marginal revenue minus marginal cost.

See the formula below. The column should look like this. Marginal profit is the profitability of each additional unit sold.

You can find this number by multiplying the current price per product by the current number of products sold. The marginal tax rate is a rate charged on taxable income for every additional dollar earned. Below is the marginal revenue formula.

How to calculate marginal revenue. The representation of the marginal revenue equation is Marginal revenue Change in total revenue change in quantity And symbolically represented as MR TR Q So initially you need to use the total revenue formula accounting to calculate the total revenue and then determine the change in the earnings with respect to the change in the. For example if the sales tax rate is 6 divide the total amount of receipts by 106.

During production costs may increase or decrease. To calculate the marginal revenue a company divides the change in its total revenue by the change of its total output quantity. Q is the profit-maximizing output level.

Pizza Princes marginal product when going from two employees to three is an increase of seven pizzas. As such the calculation. If we calculate the mean average of the growth rates we calculated in column C well find the average growth rate of your investment.

Pizza Princes marginal product equation is 22 - 15 3 - 2. Marginal revenue is equal to the selling price of a single additional item that was sold. One change in revenue Total Revenue Old Revenue and two change in quantity Total Quantity Old Quantity.

What is total revenue. The AVERAGE function tells you the mean average of a set of numbers. Assists in concentrating resources where excess marginal revenue over marginal costs are at its highest.

We discussed the calculation of marginal revenue examples a calculator and a downloadable template. A driving factor behind the relationship between the military and the defense-minded corporations is that both sides benefitone side from obtaining war weapons. If this company had started with 500000 it would have seen 5 revenue growth.

Because profit maximization happens at the quantity where marginal revenue equals marginal cost its important not only to understand how to calculate marginal revenue but also how to represent it graphically. Revenue growth can be measured as a percent increase from a starting point. Each individual unit of a good or service has.

Marginal Revenue Formula Examples How To Calculate

Comments

Post a Comment